Understand your insurance cover

You have natural hazards cover if you have a home insurance policy that includes fire insurance (and most do). The premium you pay your insurer includes a Natural Hazards Insurance levy (NHI levy), which gives you access to this natural hazards insurance.

If your property is damaged by a natural disaster, we can provide the first layer of insurance for your home and cover for some of your residential land. It’s important to understand what is and isn’t covered by us, and also by your insurer.

Your cover changed on 1 July 2024

From 1 July 2024, our new governing legislation, the Natural Hazards Insurance Act 2023 (NHI Act), came into effect. The NHI Act modernises and replaces the Earthquake Commission Act 1993 (EQC Act).

Although cover is similar under both Acts, the date the natural hazard damage first occurred will affect whether your claim is subject to the NHI Act or the EQC Act.

If you are making a claim for damage from a natural hazard event that first occurred:

- on or after 1 July 2024, your claim is subject to the NHI Act, and is referred to as an NHCover claim

- before 1 July 2024, your claim is subject to the EQC Act, and is referred to as an EQCover claim.

This page provides a general summary of your cover, and does not replace the requirements of either Act. The limits of your natural hazards cover is set out in the Acts. Please refer to the relevant Act to for more detail about what you are entitled to with NHCover or EQCover.

We use language from both Acts on our website, and the words natural hazard and disaster are used interchangeably and have the same meaning.

In the event your home is damaged by a natural hazard event, please contact your insurer to make a claim. They will assess and manage your claim from start to finish, including the EQCover or NHCover portion on our behalf. Your insurer will be your central point of contact during the claim process and can answer any questions you have.

If you have an insurance broker

Brokers may be able to manage most communication with your insurer on your behalf and make a claim for you if you authorise them to do so. Contact your broker to confirm how they can help you with your claim.

When to contact us directly

If your insurer does not partner with us, or you are a Direct NHCover customer please use our web form to get in contact.

Read more about making a new claim or managing an existing claim.

New Zealand’s geography and location make us prone to a range of natural hazards. Our natural hazards cover insures you against damage from:

- earthquake

- landslide (also known as a natural landslip)

- volcanic activity

- hydrothermal activity

- tsunami

- storm or flood (land cover only)

- fire caused by any of the natural hazards listed above.

You may also be covered for imminent damage, which is damage that hasn’t happened yet, but is more likely than not to happen in the 12 months following the natural hazard event.

The premium you pay your insurer for home insurance automatically includes a Natural Hazards Insurance levy (previously called the EQC levy). This is the amount you pay for access to natural hazards cover. The maximum levy is currently $480 plus GST per year.

Cover for your home

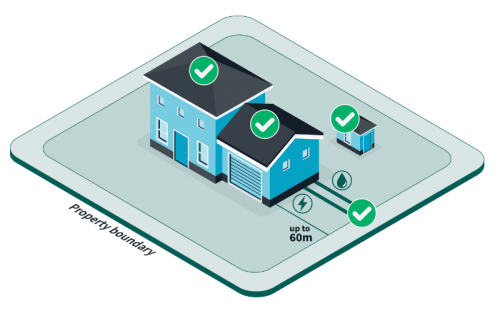

For damage from a natural hazard event, we provide cover for your home, and for some related buildings such as sheds and garages.

Download the Guide to natural hazards cover

your home or holiday home

your home or holiday home- related buildings or structures that you use as part of your day-to-day living, such as sheds, garages or pergolas

- some essential services associated with your home, up to 60 metres from your home, such as water, drainage, sewerage, gas, electricity and telecommunications.

Depending on whether your claim is subject to the NHI Act, or the EQC Act, there are some small differences in cover for the services associated with your home.

Please refer to the relevant Act for more detailed information on the services that are covered:

- section 12 of the NHI Act

- section 2 of the EQC Act.

- any building that did not have a valid home insurance policy that included fire, at the time of the natural disaster

- ‘consequential’ losses that might happen after the disaster, such as theft or vandalism

- the cost of staying somewhere else temporarily.

We will sometimes refer to a home or holiday home as a dwelling, which is the word used in the NHI Act.

A dwelling is defined as any residential premises that is:

- self-contained, and

- either used as a home or holiday home, or

- capable of being used and intended to be used as a home or holiday home.

A dwelling can be a stand-alone house, or in a group of flat, units or apartments.

Long term accommodation for the elderly, for example a rest home, are now also considered to be a dwelling for all claims for natural hazard damage that first occurred on or after 1 July 2024, under the NHI Act.

For each natural hazard event that happens, there is a maximum that we can pay towards rebuilding or repairing your home. This maximum amount is called the building cover cap and is generally $300,000 plus GST.

Any cover over this amount is provided by your private insurance policy. The maximum settlement amount that you can be paid is set out in your policy and it’s important to regularly check that this is enough to rebuild.

Your settlement amount will be based on the cost to repair damage or replace your home to a standard that is similar to when it was new. This is known as the replacement cost. Refer to section 32 of the NHI Act for more information about replacement cost.

When the building cover cap is less than $300,000 plus GST

In some circumstances you may have a building cover cap that is less than $300,000 plus GST specified in your private insurance policy, for example if your replacement sum insured is less than that. Please talk to your insurer if you have questions about this.

Your building cover cap will also be lower than $300,000 plus GST if you are claiming for damage from a natural hazard event that occurred before 1 October 2022.

Regardless of what building cover cap applies to your claim, the maximum settlement amount that you can be paid is set out in your private insurance policy.

If you own a building, or part of a building that has more than one home or apartment in it, you can get natural hazards cover for each of those homes. It’s important to tell your insurer how many homes are in your building, to make sure you have the correct amount of insurance, and NHCover for each home.

Limited cover for your land

New Zealand is one of the only countries in the world to have natural hazards insurance that covers residential land. Although our natural hazards cover is mostly intended to help repair damaged homes, it also provides some cover for the land that is necessary for supporting and accessing a home.

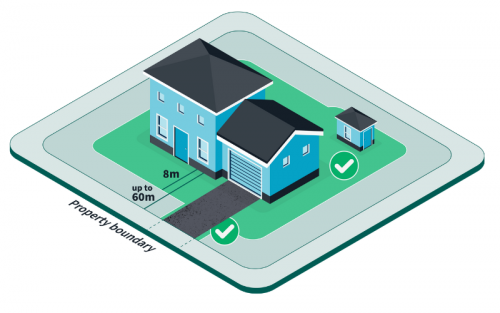

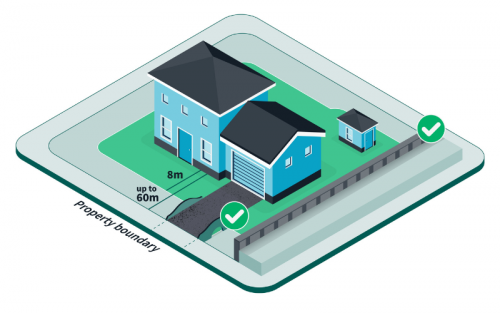

We provide limited cover for certain areas of land under and around your home, and limited cover for some bridges, culverts, and retaining walls.

We do not provide insurance for bare land without an insured home on it.

Our land cover is not intended to be a comprehensive cover and it sometimes won’t be enough to fully repair all of the damage to your land after a natural hazard event. It’s important that you know which parts of your land are included, and what is not covered.

Our natural hazards cover is the only land insurance that is available in New Zealand, and you can’t buy additional cover for land through your insurer. However, insurers may provide additional cover for some parts of your property such as retaining walls, and for parts of your property that we don’t cover such as your driveway surfaces and landscaping. Please talk to your insurer about what is included in your policy.

Download the Factsheet: land cover and claims

under your home

under your home- under some related buildings and structures

- within 8 metres of your home, and some related buildings and structures

- under or supporting your main access way up to 60 metres from your home, for example under your driveway,

Any land outside of these areas is not insured.

We can only cover land that is inside your property boundaries shown on the record of title, or where you have a legal right to cross or use someone else’s land for a specified purpose, such as a right-of-way easement for a driveway on your neighbour’s land.

We provide limited cover for bridges and culverts:

- that are located on the land that is within 8 metres of your home and insured related buildings, or

- on the land under or supporting your main accessway, up to 60 metres from your home.

We provide limited cover for some retaining walls:

- that support or protect your home, insured related buildings and insured land, and

- are within 60 metres of your home.

- driveway surfacing

- paving or other artificial surfaces

- trees and gardens

- landscaping, such as non-structural retaining walls or fences

- council land such as parks or reserves.

To better understand the parts of your property that are not covered by natural hazards cover, go to What we don't cover.

If your land has been damaged by a storm or flood, we can often contribute to the cost of cleaning up the insured parts of your land, as a part of your settlement. This can include the cost of removing silt and debris, and repairing land scour.

If you are affected by damage to neighbouring or shared land, such as a shared driveway, please contact your insurer first. Then you can work with your neighbours to repair the damage or make the land safer.

You are covered for the cost of repairing damage, up to the land cover cap, which is based on the value of your insured damaged land.

If the cost of repairing the damaged land is more than the value of that land, settlement will be based on the market value of the portion of land that was damaged. This is the maximum amount that we can pay and is called the land cover cap.

The land cover cap is calculated by adding:

- the market value of the parts of your insured land that have been damaged, plus

- the value (which is assessed differently under the NHI Act and the EQC Act) of any insured retaining walls, bridges, and culverts, to a limit.

Market value of land

When calculating the maximum amount that you can be paid (the land cover cap), we use the market value of your land. Market value is its estimated value on the day the damage happened. An independent valuer will usually base the market value on its estimated value on the day the damaged happened.

Value of retaining walls, bridges and culverts

Your entitlements for any natural hazard damage to retaining walls, bridges and culverts depends on the date that the damage first occurred. Claims for damage from natural hazard events that first occurred:

- before 1 July 2024 are subject to the EQC Act, and are called EQCover claims.

- on or after 1 July 2024 are subject to the NHI Act, and are called NHCover claims.

EQCover claims use the indemnity value of any retaining walls, bridges and culverts when calculating the land cover cap. Indemnity value means how much something would cost to replace with a similar structure to what the damaged one was, after making deductions to allow for its age and condition. The indemnity value of retaining walls, bridges and culverts is usually less than what it would cost to replace them with new ones.

NHCover claims use the undepreciated value of any retaining walls, bridges and culverts when calculating the land cover cap, to a limit. The undepreciated value is how much it would cost to replace with a similar structure to what the damaged one was, in new condition. This doesn’t include the cost of any modifications that might be required for the structure to comply with any building code.

For NHCover claims there is a maximum amount that we can pay which is:

- $50,000 plus GST for all your retaining walls

- $25,000 plus GST for all your bridges and culverts.

Read more about your entitlement for retaining walls, bridges and culverts:

- section 2 and section 19 of the EQC Act

- section 43 and section 45 of the NHI Act.

If it is determined that all or part of the insured land can’t be repaired, or it is not feasible to repair, some or all of your settlement might be decided by diminution of value. Diminution of value compares the value of your land before it was damaged to its value after it was damaged. We may pay the difference, up to the land cap as part of your settlement.

Excess for natural hazards cover claims

If your claim is accepted, you pay a small part of the cost. This is called the excess, and it is taken from your settlement amount before that is paid to you.

There is a separate excess for building claims and land claims. If your claim is for both your home and land, both will be deducted.

If the cost of replacing or repairing your property is less than the excess, then no settlement payment will be made. You will need to meet the cost of repairing the natural disaster damage yourself.

The way your excess is calculated depends on the date that the natural hazard damage first occurred. Claims for damage that first occurred:

- before 1 July 2024 will have their excess calculated based on the EQC Act

- on or after 1 July 2024 will have their excess calculated based on the NHI Act.

These figures include GST.

Building excess

The excess for a building claim is 1% of the total settlement amount, with a minimum of $200 per insured home to a maximum of $3,450.

Land excess

The excess for a land claim is 10% of the total settlement amount, with a minimum of $500 per insured home, to a maximum of $5,000.

These figures include GST.

Building excess

The excess for a building claim is $500 per insured home.

Land excess

The excess for a land claim is $500 per insured home.

There is a maximum excess of $5,000 for buildings with more than 10 insured homes.

What we don’t cover

We don’t cover any building that did not have a valid home insurance policy that included fire, at the time of the natural disaster.

After a disaster we don’t cover ‘consequential’ losses that might happen, such as theft or vandalism, or the cost of staying somewhere else temporarily.

We also don’t provide cover for the property items listed below, but your insurer might. Please talk to your insurer to find out what is included in your policy.

In most situations we don’t cover:

- paths, stairs, and walkways and other forms of access (other than the insured land under your main access way)

- paving or other artificial surfaces, for example driveway surfacing

- living things, for example trees, gardens and lawns

- landscaping (non-structural walls)

- sports fields or courts and any associated structures

- jetties, wharves or landings

- drainage ditches, open drains, channels, tunnels and cuttings

- dams, breakwaters, reservoirs

- fences or poles

- swimming pools, recreational baths and spa pools

- tanks and other structures used to store water, other liquids, or gas (unless they are used primarily by the household occupants for household purposes)

These property items may be covered in certain situations, for example if these items are built into your home and not easily removed. Please talk to your insurer if you have any questions about what is and is not covered.

For the full detailed list of property exclusions please refer to:

- schedule 2 of the EQC Act, if your claim is for damage that first occurred before 1 July 2024

- schedule 2 of the NHI Act, if your claim is for damage that first occurred on or after 1 July 2024.

Section notices can affect your cover

There are two types of notice that may be put on a property's record of title that could affect natural hazards cover.

A section 72 notice on a property’s record of title can affect claims for natural hazard damage. This notice is intended to make anyone involved with the property, such as potential buyers, banks, lenders and insurers, aware that the property is known to be affected by or at risk of natural hazards, as well as specifying what that hazard is.

If a claim is made for damage that was caused by the same type of natural hazard (or hazards) that is specified in the section 72 notice, NHC Toka Tū Ake have the right to fully or partly decline that claim.

Read more about section 72 notices

There are some specific situations that could lead to NHC Toka Tū Ake limiting or cancelling natural hazards cover after cash settling a claim. This usually happens when there is significant damage to a property, and the homeowner has not taken steps towards making repairs, within a reasonable timeframe.

In these situations, we will first ask to see that progress is being made with repairing or replacing the property. If we are not satisfied with progress, we will notify the homeowner of our decision to limit or cancel cover in writing.

Read more about the limitation or cancellation of cover

Direct NHCover

If you have been unable to purchase NHCover through a private insurer for reasons other than natural hazard risk, you can apply for Direct NHCover. The NHCover that you buy directly from us is the same as what you would buy through your insurer.

To be eligible, you must have been unsuccessful in applying for insurance through the private market. We are unable to provide Direct NHCover because of high private insurance premiums. We consider applications on a case-by-case basis.

Please contact NHCover@naturalhazards.govt.nz for more information about Direct NHCover.

Changes to the building cap, levy, and excess

The Government will sometimes make changes to the building cap, levy, and excess to keep up with rising building costs. This makes sure that homeowners in New Zealand continue to have access to our natural hazard insurance cover.

The maximum amount that we can pay for damage to your home is called the building cap. Any cover over this cap is provided by your private insurance policy.

On 1 October 2022, building cap increased from $150,000 plus GST to $300,000 plus GST.

This increase was introduced gradually over the next year to take effect when:

- your existing insurance policy reached its first anniversary date after 1 October 2022, or

- you entered a new insurance policy on or after 1 October 2022.

Note: Your anniversary date is the date that you were first issued your policy. This may be different from your renewal date.

The date that the natural disaster damaged occurred will affect what building cap applies to your claim.

Following 1 October 2022, if damage occurred:

- after your policy anniversary date, the building cap is $300,000 plus GST per home

- up until your policy anniversary date, the building cap is $150,000 plus GST per home.

The premium you pay your insurer includes an NHI levy (previously called the EQC levy). This levy is what gives you access to our natural hazards insurance cover. The maximum levy was increased from $300 plus GST to $480 plus GST.

The increase to the levy came into effect from 1 October 2022, at the same time that your building cap increased to $300,000 plus GST.