Get to know your natural hazards cover

Natural hazards can be unexpected. What your insurance covers shouldn’t be.

If a natural hazard affects your home, insurance for your property is provided by both the Natural Hazards Commission and your private insurer. Contact your insurer to make a claim.

In New Zealand, NHC provides natural hazard cover for some parts of your residential land – but it has limits. You can’t buy extra land cover from your insurer, so it’s important to know what is and isn’t included.

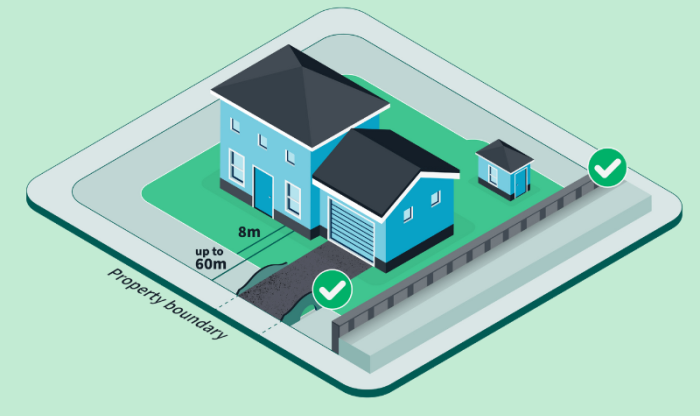

You're covered for a limited area of land:

- under and up to 8m around your home, related buildings, and structures

- under or supporting your main access way, up to 60m from your home.

Land cover is often only a contribution to repairs, and may not be enough to fully repair all of the damage.

If your home is damaged by an earthquake, landslide, volcanic or hydrothermal activity, or tsunami, NHC covers the first $300,000 and your private insurance covers the rest, up to your policy limits.

You're covered for:

- your home or holiday home

- related buildings or structures that are used as part of your day-to-day living, such as sheds, garages, or pergolas

- some essential services associated with your home, such as water supply, gas or electricity.

If your property is damaged by storm or flood, your insurer covers the damage to your home as per your policy and NHC provides limited cover for your land. We can contribute to the cost of cleaning up the insured parts of your land, as part of your settlement.

We can’t pay you for any work you do to clean up your land yourself, but we can contribute to the costs of:

- removal of silt that is 15mm or deeper

- removal of debris

- repairing land scour (when the surface of land is washed away).

You're covered for some retaining walls, bridges and culverts, to a limit.

We provide limited cover for bridges and culverts:

- that are located on the land that is within 8 metres of your home and insured related buildings, or

- on the land under or supporting your main accessway, up to 60 metres from your home.

We provide limited cover for some retaining walls:

- that support or protect your home, insured related buildings and insured land, and

- are within 60 metres of your home.

Your insurer may provide additional cover for some parts of your property, like retaining walls. Talk to your insurer about what's in your policy.

Find resources available in multiple languages, easy-read formats, and accessible versions for people who are blind or have low vision.

Videos about your cover

This information provides a general summary of the insurance we provide under under our governing legislation, being the EQC Act for claims for damage that occurred before 1 July 2024, and the NHI Act for claims for damage that occurred on or after 1 July 2024. The Acts will always prevail over the content of this webpage.

- We use the term “home” in this information while the Act uses the term “dwelling”.

- Generally, everyone with valid private insurance for their home or holiday home that includes fire insurance pays the Natural Hazards Insurance levy and has access to our insurance cover.

- Some insurers may offer additional top- up cover for land structures such as retaining walls, bridges and culverts. Talk to your insurer to find out what extra cover is available.

- Information in this webpage is valid for homeowners who pay the Natural Hazards Insurance levy through a private insurer that is a member of the insurance partnership with us. For Direct NHCover customers or those whose private insurer does not partner with us, details on how you access NHCover or make a claim may be different.